when are draftkings tax forms available

Draft a new lineup whenever you want. Why am I being asked to fill out an IRS Form W-9.

Tulalip Resort Casino Sportsbook

A majority of companies issue tax forms by january 31st every year as required by law.

. However if you havent received yours dont worry. Does Draftkings Provide Tax Forms. 41nsk7bcouwizm draftkings tax form 1099 where to find it how to fill 41nsk7bcouwizm draftkings sportsbook nj promo code for 1 050.

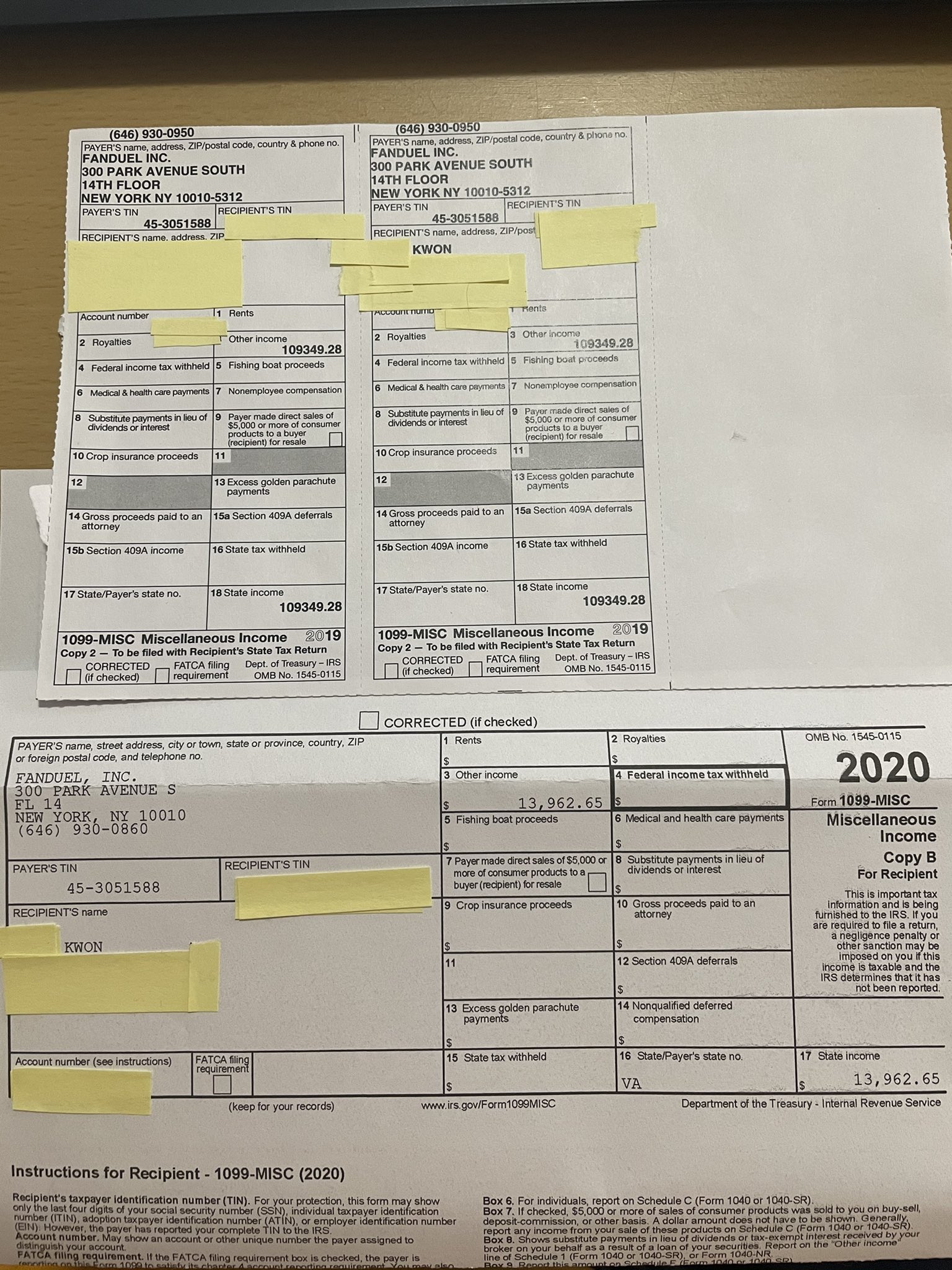

FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it. If they dont issue one to you you. A separate communication will be.

As ubuckybadger26 said they have until January 31st to get the forms to you and the IRS. Make your first deposit. We should mention that most bettors should have received their draftkings 1099 forms in the mail after february 1st.

Play in a public contest and against friends in a private league. Once you have reached 600 in net profit during a calendar year draftkings will issue a. The requirements for reporting and withholding.

Over 50 million tax returns filed. DraftKings customers are required to fill out an IRS Form W-9 following a reportable win. As sports begin a slow return daily fantasy sports companies could potentially owe millions more in taxes due to new government guidance.

If your net earnings were 600 and are expecting a 1099 but have not received a hard copy of your form in the mail you can access this from the website both via desktop or mobile device. Mile_High_Man 3 yr. Fan Duel sent me mine via e-mail about a week ago.

We should mention that most bettors should have received their draftkings 1099 forms in the mail after february 1st. Pick from your favorite stars each week. If theyre going to issue one to you they probably havent yet.

The best place to play daily fantasy sports for cash prizes. We should mention that most bettors should have received their DraftKings 1099 forms in the mail after February 1st. Quickly enter a contest any time.

Key tax dates for DraftKings - 2021 Forms 1099-MISC and Forms W-2G will become available online prior to the end of February IRS extended due date.

Canzano Draftkings Lands In Oregon But Lawmakers Must Wake Up And Lift College Wagering Ban Oregonlive Com

Draftkings Acquires Las Vegas Based Vsin Boston Business Journal

Maryland Sports Betting Apps Get 300 Pre Launch Promos

Draftkings Fanduel Ban Employees From Daily Sports Betting After Insider Trading Allegations

Nft And Dfs Cpa On Twitter Posting This For A Few Reasons Fanduel Sent Out 1099s Let S Do Some Tax Planning Link In Bio Or Dms Through Hard Work Financial Dfs Goals

Daily Fantasy Sports Tax Reporting

Amid Us Legal Battle Draftkings Set To Kick Off Soccer Contests In Uk The Boston Globe

Draftkings Inc Current Report 8 K

Expanded Irs Free File System One Step Closer In Dems Bill Amnewyork

Draftkings Fined 150k By Nj Regulators In Proxy Betting Settlement

Daily Fantasy Sports And Taxes Dissecting The 1099s

Illinois Sports Betting Goes On Apps Online With New Statewide Move Abc7 Chicago

Goldman Sachs Says Put Your Money On Draftkings Penn National

Analysis What To Make Of Sec Irs Investigations Into Draftkings

Daily Fantasy Sports Tax Reporting

How To Pay Taxes On Sports Betting Winnings Bookies Com

Football Betting Is In Full Swing Don T Forget The Taxman If You Win

Started Draftkings February 2022 Can Someone Explain What I Will Need To File For Taxes Is It Just Net Winnings R Draftkingsdiscussion

Fantasy Sports Betting In Louisiana Could Start Today After First Company Gains Approval Business Theadvocate Com